An inside look at how 2290ASAP

An inside look at how 2290ASAP

Blog Article

The Internet is a great place to look for good deals on just about anything. This includes muscle supplements, from beginners using protein, to the advanced lifters using prohormones . When looking online it is important to find a secure site that has quality products that will give you results. There are thousands of sites that are selling supplements and it can be difficult choice to pick which site you can trust. On top of that one must try to find safe and effective supplements to use.

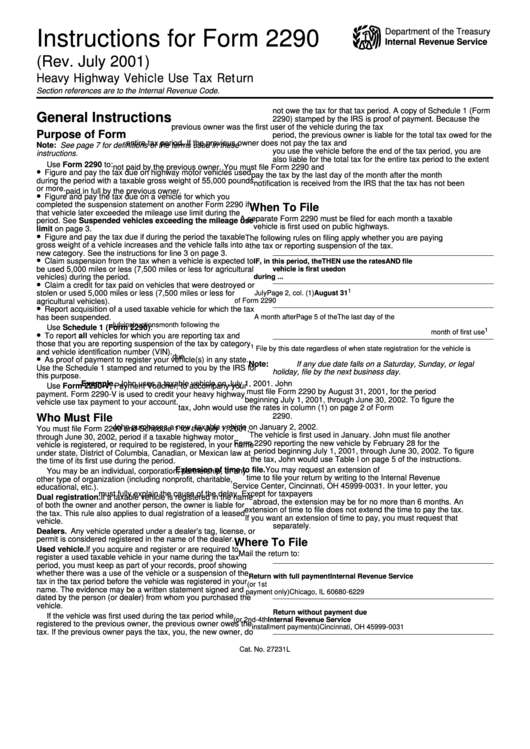

Owners and operators of buses, tractor trailers, and rigs all agree that electronically filing helps you to focus more on time on the road than paperwork. Now you can get proof of paying these 2290 tax form right in your email box. When tax assessment time comes around on July 1st be ready to take advantage of this easy filing option. Also remember that no matter when the truck was purchased, for the upcoming tax year the due date to file is August 31st unless noted otherwise by the IRS.

15. Being Accused Of Cheating Yourself. Guilt Truck tax is a Form 2290 online heavy burden cheating spouses carry on their shoulders. It is extremely common that a cheating spouse will begin accusing yourself of cheating. There are a couple of reasons for this action. First it causes you to worry about them thinking you are cheating, and forces you to try and prove your innocence instead of noticing their own changes in behavior. Secondly, cheating spouses assume that everyone cheats, and since they are doing it you must be cheating as well. This also helps to justify their actions by giving them justification for their own.

Form 2290 is essential for all truckers as it has been a federal government requirement since 1950. The normal process of filing and sending a tax form is long and difficult. Form 2290 Electronic filing is quicker and less expensive than other forms. It also saves time and energy.

A other thing I have to tell you is that this is not a Free gimmick. You need to have at least some resources to implement this or it's not possible to IRS heavy vehicle tax copy my idea.

When you do home improvements you can use these to claim on your income tax at the end of the year. By improving the value and paying higher taxes, you will have a higher, real estate tax deduction when you claim your homeowner's tax.

Missing your 2007 federal income tax isn't a huge disaster. In fact, it's never been easier to fix it thanks to many small businesses that specialize in helping taxpayers through exactly this kind of problem. The sooner you file, the sooner you'll see.